Contact your mortgage broker for more information.

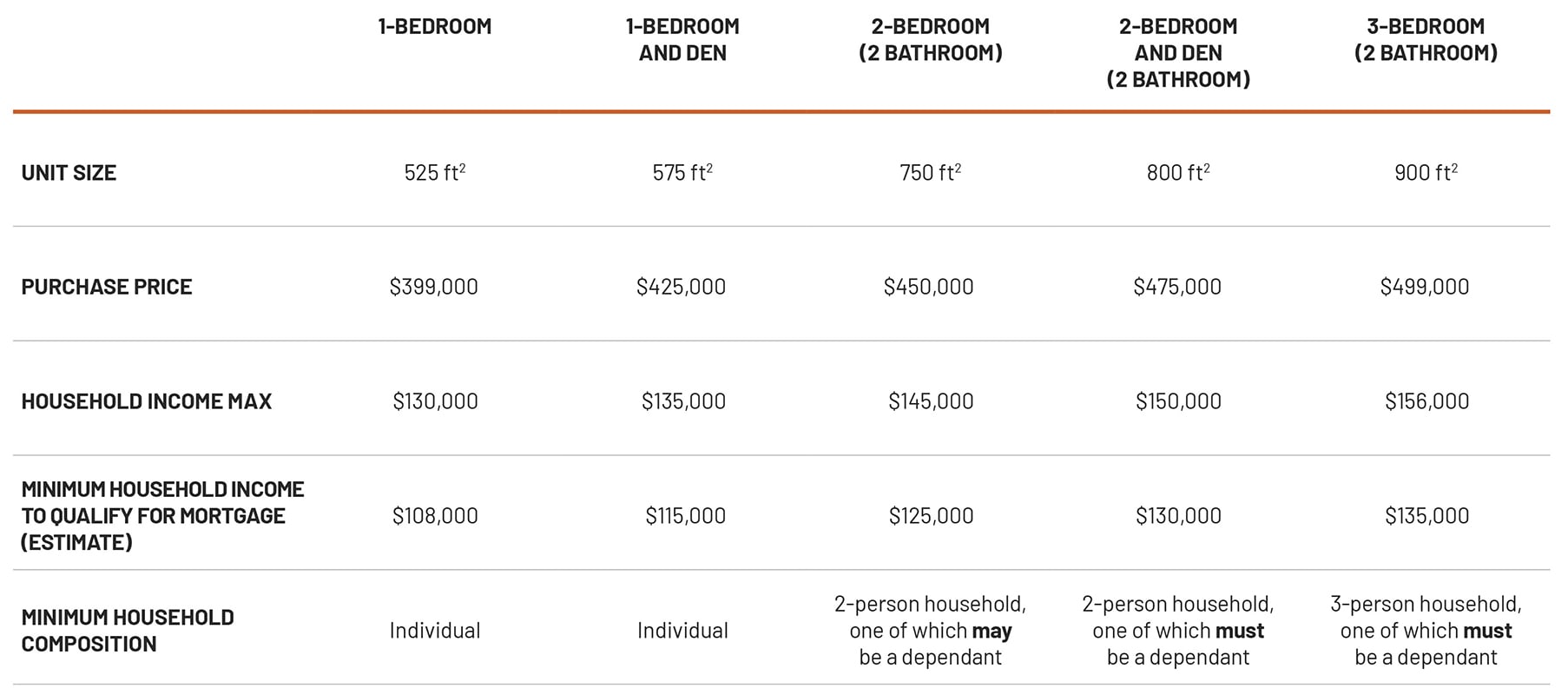

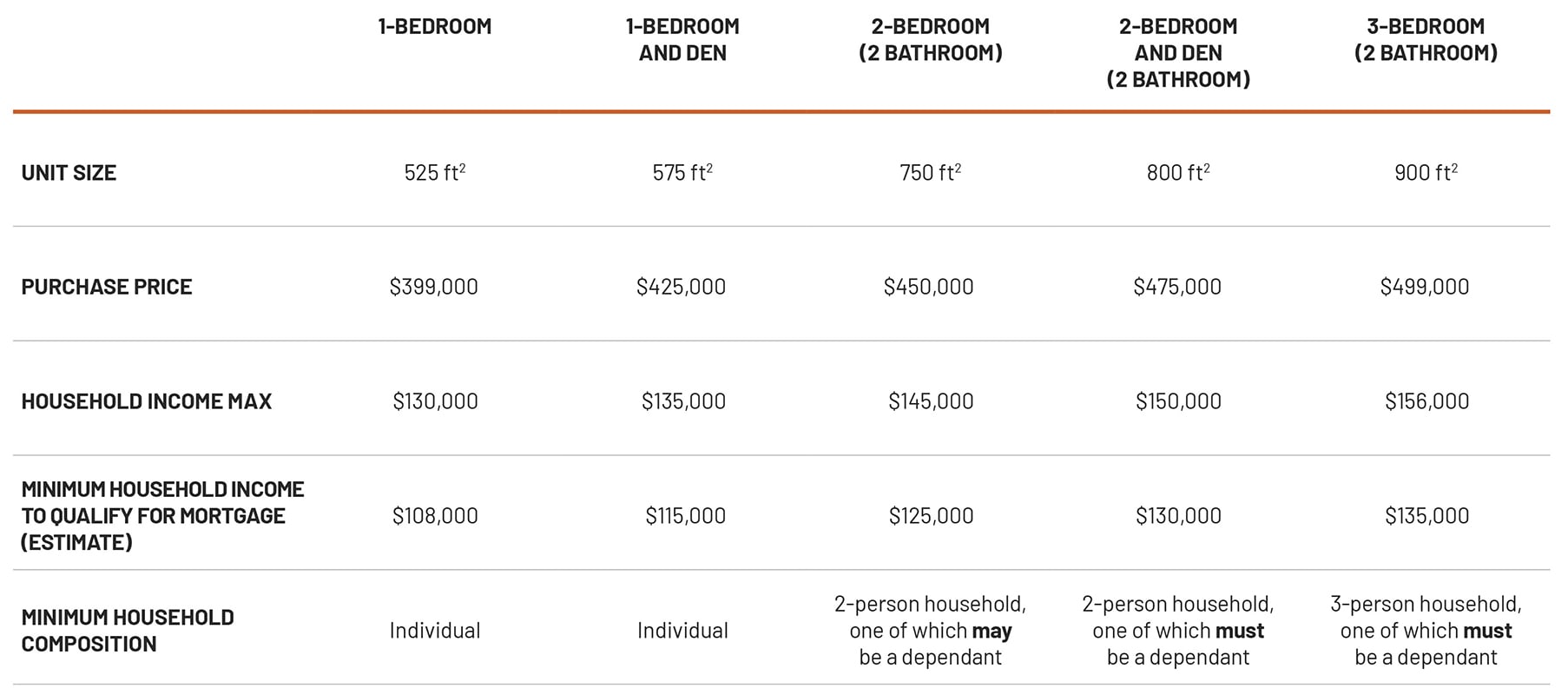

This pilot program provides down payment assistance to individuals and families to help them purchase a condo in participating new developments that have a purchase price of no more than $399,000 – $499,000, dependent on unit size. This program is intended to help people who may qualify for a mortgage but are unable to save the minimum down payment.

Once deemed eligible by City staff, qualifying buyers will be given a Commitment Letter that outlines how much assistance will be granted. When a building with eligible units becomes available for pre-sale, the qualifying buyer would be invited to enter into a purchase and sale agreement with the developer on a first come – first serve basis. The qualifying buyer would have to show their Commitment Letter as proof of eligibility for the unit.

The City would grant to a qualifying homebuyer a certain percentage of the necessary 5% down payment at the time of closing*. Assistance will be granted on a sliding scale based on gross annual household income:

- Less than $129,999 would receive 75% of the down payment

- $130,000 to $139,999 would receive 50% of the down payment

- $140,000 to $156,000 would receive 25% of the down payment

To calculate estimated assistance, use our calculator below. Simply enter your household income and then select the unit type you would like from the dropdown. The form will auto-calculate, mortgage required, downpayment as well as the assistance amount:

* Assistance amounts will need to be fully confirmed during the application process.

Applications are now being accepted, please apply.

If you currently work in Langford and have for a minimum of 6 months, you are eligible to apply.

Yes. Each unit will have a minimum of 10 ft by 10 ft bedroom size (excluding closet) and be comprised of the following:

- 1-bedroom, 1 bathroom (525 square feet)

- 1-bedroom, 1 bathroom and den (575 square feet)

- 2-bedroom, 2 bathroom (750 square feet)

- 2-bedroom, 2 bathroom and den (800 square feet)

- 3-bedroom, 2 bathroom (900 square feet)

No, a Housing Agreement registered on title would prevent an owner from renting their unit during the first five years of ownership.

A Housing Agreement that would be registered on title would limit the sale price of the unit if it was sold within the first five years of ownership.

An eligible dependent can fit one of the following two categories:

- Cohabitating, unmarried children under 18 years of age; or

- Cohabitating, unmarried children, siblings, parents or spouse who are physically or mentally incapable of self-support (i.e. they fit the definition of permanent mobility impairment or disability);

The definition of children, for the purposes of this application, can include natural children, legally adopted children and step-children, but does not include temporary foster children or children that do not reside with the applicant for at least 50% of the year.

A mobility impairment or disability can be defined as a permanent condition, which features:

- total or partial loss of the person’s bodily or mental functions; or

- total or partial loss of a part of the body; or

- the presence in the body of organisms causing disease or illness; or

- the malfunction, malformation or disfigurement of a part of the person’s body; or

- a disorder or malfunction that results in the person learning differently from a person without the disorder or malfunction

As long as you do not currently own real estate and meet all the other eligibility requirements, you would qualify for the program.

The grant money will come from the City’s Affordable Housing Reserve Fund, which is funded by contributions provided by developers as a condition of rezoning for increased density. No taxpayer dollars are allocated towards this Fund.